Debt consolidation is a way to simplify and manage your debt by combining multiple debts into one. Instead of paying various bills with different interest rates and due dates, you take out a new loan to pay off all your existing debts. Now, you only have one monthly payment to make, usually at a lower interest rate.

In summary, debt consolidation can make managing your debt easier and more affordable, but it’s important to understand the terms and potential costs involved

Suggested reads:

Air India Express President Aloke Singh on May 8 said that the carrier will diminish trips throughout the following couple of days because of countless lodge team announcing debilitated not long before their booked obligations. This disturbance has prompted the wiping out of north of 90 flights, influencing tasks across the organization, Singh said in…

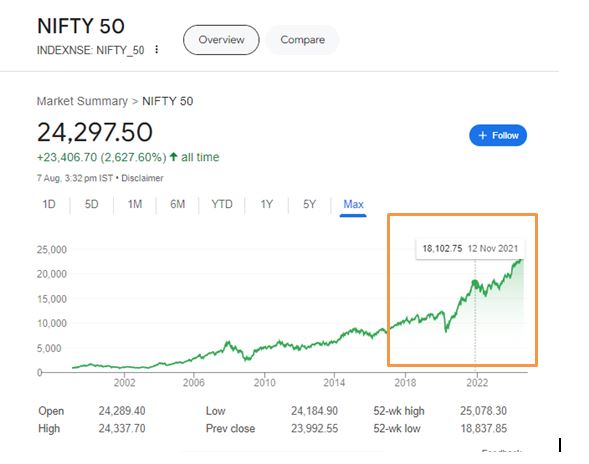

Reason why stock market fall is roughly 2.68% now natural question that comes to mind is why the market has fallen and is the market going to fall more from this level if yes then how much would it be? Let us discuss the first question why the market has fallen the market has been…

What is Macroeconomics ? First of all, let us understand on a nutshell what macroeconomics is At its core, macroeconomics is the branch of economics that studies an economy’s overall functioning and phenomena at a large scale. Unlike microeconomics, which focuses on individual households and firms, macroeconomics looks at the economy as a whole, analyzing broad…