How Macroeconomics Impacts Share Market?

What is Macroeconomics ?

First of all, let us understand on a nutshell what macroeconomics is At its core, macroeconomics is the branch of economics that studies an economy’s overall functioning and phenomena at a large scale. Unlike microeconomics, which focuses on individual households and firms, macroeconomics looks at the economy as a whole, analyzing broad aggregates and how they interact. By studying macroeconomics one could predict future market trends with a certain degree of accuracy, of course, no one can predict with absolute certainty what is going to happen in the future but by using macroeconomics understanding your analysis and bets would have a higher chance to turn into your favor.

QE(Quantitative Easing) QT (Quantitative Tightening)

Now you must be wondering what these fancy-looking terms i.e. QE(Quantitative Easing) and QT(Quantitative Tightening) are, these terms are used in macroeconomics QE means when there is more cash flow in the economy because of N number of reasons one of the most prominent reason could be the government cuts IR(interest Rate), Money printing which as a result increase credit flow in the economy which encourages people and investors to borrow more at a cheaper rate and use those funds for their consumptions or investment and by investing in the asset class for example (Bonds, stock market, real state, etc.) the assets inflation takes place which results in the stock market rise or any other assets class rise wherever the money is being deployed.

The second term here is QT(Quantitative Tightening) as the name suggests it is just the opposite of QE(Quantitative Easing) when the government wants to withdraw liquidity from the market it increases IR(Interest Rate) for public which as a result discourages people from borrowing from banks and when people have less liquidity they invest less and consume less.

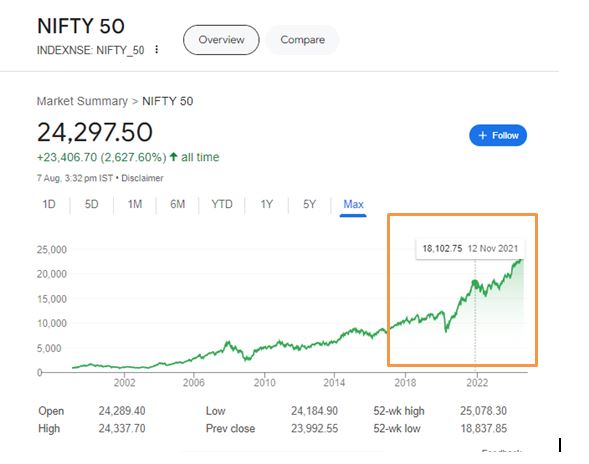

let me show you some examples of when these QE(Quantitative Easing) took place let us take most recent example which is COVID crash during COVID crash there were so many negative things that has played out there was lockdown people were bound to stay home literally the economy was shut for a quite a time then but just look at the data below see the chart the market went to almost 18000 levels at that time zone around 2021 when there was 2nd wave of COVID playing out

As you can see with just these two simple terms QE(Quantitative Easing) and QT (Quantitative Tightening) the market can go UP and Down by a lot so if you simply understand these two terms and can predict when QE and QT going to happen you can beat most of traders and investors in terms of generating return.